Riverside Inflation

RIVERSIDE (CNS) – Inflation throughout the Riverside metropolitan area climbed 1.4% over the previous two months, largely driven by rising energy costs, according to data released Wednesday by the U.S. Bureau of Labor Statistics.

The agency’s bimonthly report, which covers northwestern Riverside County as well as the cities of Ontario and San Bernardino, indicated that the metro area’s Consumer Price Index shifted to an upward trajectory compared to the start of the year, when a mix of increases and offsetting decreases left the CPI flat.

BLS officials said the energy sector was the primary driver of pocketbook pressure from the beginning of February to the end of March. Gasoline prices jumped 8.8%, while electricity costs rose 3.2%, and natural gas prices notched up .6%, figures showed.

Property rents also went up, reflected in the index’s “shelter costs,” which increased .9% over the two-month period.

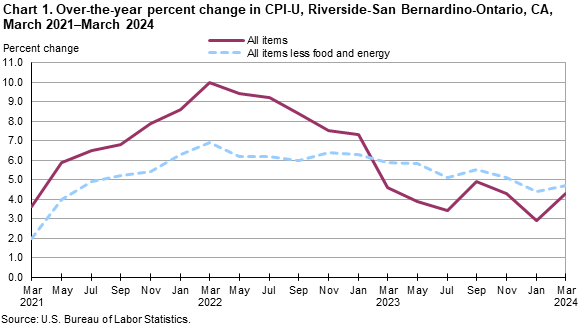

Longer term, the regional CPI was 4.3% higher over the previous 12 months, with rents leading the advance at 7.4%, according to data.

Energy prices were up 3.1%, led by electricity costs, which leapt 10% year-over-year. The BLS said food prices rose 2.6% during the period, and health care expenses were 5.5% higher.

Price tags on some items fell over the last 12 months, including those for household furnishings, which rated a 4.4% drop, and costs on motor vehicles, which declined 3.4%, according to the index.

The report showed inflation was up .4% nationwide in March, and 3.8% from March 2023 to March 2024.

The current rate of inflation reflects the elevated price trajectory impacting most sectors of the economy.

Accelerating consumer price hikes have been blamed by the Biden administration on the war in Ukraine and consequent energy supply disruptions, but critics have pointed to what they call the administration’s restrictive domestic energy policies, as well as excessive spending, including the flood of dollars contained in relief packages, as root causes.

The national debt is at $34.6 trillion, after passing $33 trillion just seven months ago, according to the U.S. Treasury Department. Estimated annualized interest rate payments on the country’s debt passed the $1 trillion mark in November, according to Bloomberg News. That same month, Moody’s Investors Service lowered its outlook on the U.S. credit rating from “stable” to “negative.”

The Federal Reserve’s Open Market Committee started gradually increasing its benchmark, or target, lending rate in spring 2022, though the FOMC suspended hikes beginning last summer, leaving the rate at roughly 5.5% on the belief that the pace of inflation had slowed satisfactorily.

The hikes were an attempt to soak up excess liquidity and slow spending. The upturn in inflationary pressure reflected in the latest BLS report for the nation might push FOMC decision-makers to reconsider earlier announcements regarding expectations for rate cuts, according to financial analysts.

For More Economic News Visit www.zapinin.com/economy.