Inflation

RIVERSIDE (CNS) – Inflation throughout the Riverside metropolitan area increased less than half a percentage point over the previous two months, dovetailing with the published rate for the nation as a whole, according to data released Tuesday by the U.S. Bureau of Labor Statistics.

The agency’s bimonthly report, based on metrics for northwestern Riverside County, as well as the cities of Ontario and San Bernardino, indicated that the Inland Empire’s Consumer Price Index was up .2%.

BLS officials said health care and shelter costs, or property rents, were among the main drivers of price hikes in the months of June and July. The health expenses component of the index jumped 5.4%, while the shelter burden climbed an estimated .8%.

Over the same two-month period, however, energy prices dropped, with gasoline costs declining 5.5%, despite the oil market jitters set off by Israel’s attack on Iran and the latter’s counter-strikes. The pocketbook squeeze for groceries also eased marginally in June and July, decreasing overall by .1%, according to the BLS.

The year-over-year picture contrasted with bimonthly inflationary trends. From July 2024 to July 2025, the regional CPI showed a 3.5% rise, accounting for a range of upward pressures, led by food and shelter costs.

The food index was up 3.5% over the 12-month period, while the shelter component was up 3.4%, data showed.

Trending lower year-to-year were energy costs, dropping an aggregate 1.8%, along with costs for education and communication services, which together declined by 2.8%, according to the government.

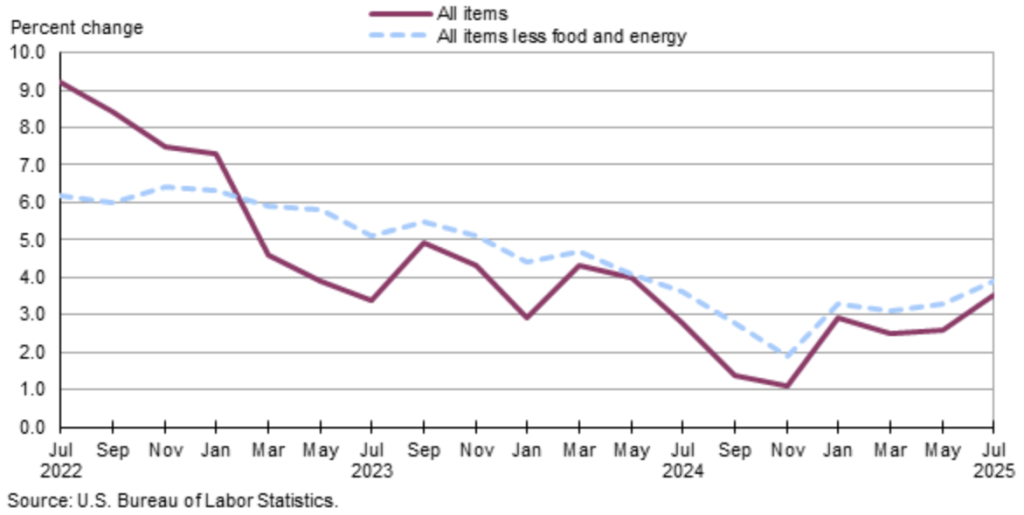

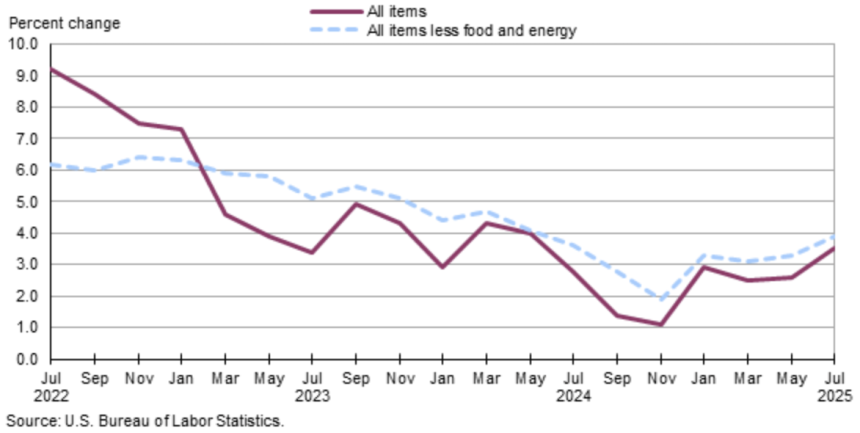

The report showed inflation was also up .2% nationwide for July, and 2.7% on an annualized basis.

The current rate of inflation reflects the price trajectory impacting most sectors of the economy.

Accelerating consumer price hikes have been blamed variously on the war in Ukraine, loose monetary policy and excessive federal spending, applying downward pressure on the dollar.

The national debt is $36.9 trillion, according to the U.S. Treasury Department. Estimated annualized interest rate payments on the country’s debt passed the $1 trillion mark in November 2023, according to Bloomberg News. That same month, Moody’s Investors Service lowered its outlook on the U.S. credit rating from “stable” to “negative.” However, last May, the service changed the rating again to stable.

The Federal Reserve’s Open Market Committee increased its benchmark, or target, lending rate in spring 2022 to soak up excess liquidity, though the FOMC stopped hikes in fall 2023 and last year initiated gradual cuts, bringing the rate down to roughly 4.5% on the belief that inflation had been tamed.

The committee decided to leave rates unchanged in July, citing uncertainties. However, many Wall Street analysts are now betting rate cuts will begin anew this fall.

For More Personal Finance News Visit www.zapinin.com