Public Notices

T.S. No.: 2023-07270-CA APN: 358-160-045 Property Address: 31230 GEARY ST , MENIFEE, CA 92584, NOTICE OF TRUSTEE’S SALEYOU ARE IN DEFAULT UNDER A DEED OF TRUST DATED 1/13/2018. UNLESS YOU TAKE ACTION TO PROTECT YOUR PROPERTY, IT MAY BE SOLD AT A PUBLIC SALE. IF YOU NEED AN EXPLANATION OF THE NATURE OF THE PROCEEDING AGAINST YOU, YOU SHOULD CONTACT A LAWYER.A public auction sale to the highest bidder for cash, cashier’s check drawn on a state or national bank, check drawn by a state or federal credit union, or a check drawn by a state or federal savings and loan association, or savings association, or savings bank specified in Section 5102 of the Financial Code and authorized to do business in this state will be held by the duly appointed trustee as shown below, of all right, title, and interest conveyed to and now held by the trustee in the hereinafter described property under and pursuant to a Deed of Trust described below. The sale will be made, but without covenant or warranty, expressed or implied, regarding title, possession, or encumbrances, to pay the remaining principal sum of the note(s) secured by the Deed of Trust, with interest and late charges thereon, as provided in the note(s), advances, under the terms of the Deed of Trust, interest thereon, fees, charges and expenses of the Trustee for the total amount (at the time of the initial publication of the Notice of Sale) reasonably estimated to be set forth below. The amount may be greater on the day of sale. Trustor: Blenner A. Caldeira and Lisa C Prenot, registered domestic partners as community property Duly Appointed Trustee: Nestor Solutions, LLC Deed of Trust Recorded 1/24/2018 as Instrument No. 2018-0028744 in Book — Page — of Official Records in the office of the Recorder of Riverside County, California Date of Sale: 7/2/2024 at 9:00 AM Place of Sale: At the bottom of the stairway to the building located at 849 W. Sixth Street, Corona, CA 92882Amount of unpaid balance and other charges: $191,338.82 Street Address or other common designation of real property: 31230 GEARY ST MENIFEE, CA 92584A.P.N.: 358-160-045The undersigned Trustee disclaims any liability for any incorrectness of the street address or other common designation, if any, shown above. If no street address or other common designation is shown, directions to the location of the property may be obtained by sending a written request to the beneficiary within 10 days of the date of first publication of this Notice of Sale. NOTICE TO POTENTIAL BIDDERS: If you are considering bidding on this property lien, you should understand that there are risks involved in bidding at a trustee auction. You will be bidding on a lien, not on the property itself. Placing the highest bid at a trustee auction does not automatically entitle you to free and clear ownership of the property. You should also be aware that the lien being auctioned off may be a junior lien. If you are the highest bidder at the auction, you are or may be responsible for paying off all liens senior to the lien being auctioned off, before you can receive clear title to the property. You are encouraged to investigate the existence, priority, and size of outstanding liens that may exist on this property by contacting the county recorder’s office or a title insurance company, either of which may charge you a fee for this information. If you consult either of these resources, you should be aware that the same lender may hold more than one mortgage or deed of trust on the property. NOTICE TO PROPERTY OWNER: The sale date shown on this notice of sale may be postponed one or more times by the mortgagee, beneficiary, trustee, or a court, pursuant to Section 2924g of the California Civil Code. The law requires that information about trustee sale postponements be made available to you and to the public, as a courtesy to those not present at the sale. If you wish to learn whether your sale date has been postponed, and, if applicable, the rescheduled time and date for the sale of this property, you may call or (888) 902-3989 or visit these internet websites or www.nestortrustee.com, using the file number assigned to this case 2023-07270-CA. Information about postponements that are very short in duration or that occur close in time to the scheduled sale may not immediately be reflected in the telephone information or on the Internet Web site. The best way to verify postponement information is to attend the scheduled sale .NOTICE TO TENANTS: You may have a right to purchase this property after the trustee auction pursuant to Section 2924m of the California Civil Code. If you are an “eligible tenant buyer,” you can purchase the property if you match the last and highest bid placed at the trustee auction. If you are an “eligible bidder,” you may be able to purchase the property if you exceed the last and highest bid placed at the trustee auction. There are three steps to exercising this right of purchase. First, 48 hours after the date of the trustee sale, you can call or (888) 902-3989 or visit these internet websites or www.nestortrustee.com, using the file number assigned to this case 2023-07270-CA to find the date on which the trustee’s sale was held, the amount of the last and highest bid, and the address of the trustee. Second, you must send a written notice of intent to place a bid so that the trustee receives it no more than 15 days after the trustee’s sale. Third, you must submit a bid so that the trustee receives it no more than 45 days after the trustee’s sale. If you think you may qualify as an “eligible tenant buyer” or “eligible bidder,” you should consider contacting an attorney or appropriate real estate professional immediately for advice regarding this potential right to purchase. Date: 5/28/2024 Nestor Solutions, LLC214 5th Street, Suite 205Huntington Beach, California 92648Sale Line: (888) 902-3989 Giovanna Nichelson, Trustee Sale Officer EPP 40267 Pub Dates 06/07, 06/14, 06/21/2024

SchId:12510 AdId:4432 CustId:77

T.S. No.: 24-30729 A.P.N.: 360-680-046 NOTICE OF TRUSTEE’S SALE YOU ARE IN DEFAULT UNDER A DEED OF TRUST, SECURITY AGREEMENT AND FIXTURE FILING (WITH ASSIGNMENTS OF RENTS AND LEASES), DATED 6/10/2022. UNLESS YOU TAKE ACTION TO PROTECT YOUR PROPERTY, IT MAY BE SOLD AT A PUBLIC SALE. IF YOU NEED AN EXPLANATION OF THE NATURE OF THE PROCEEDING AGAINST YOU, YOU SHOULD CONTACT A LAWYER. A public auction sale to the highest bidder for cash, cashier’s check drawn on a state or national bank, check drawn by a state or federal credit union, or a check drawn by a state or federal savings and loan association, or savings association, or savings bank specified in Section 5102 of the Financial Code and authorized to do business in this state will be held by the duly appointed trustee as shown below, of all right, title, and interest conveyed to and now held by the trustee in the hereinafter described property under and pursuant to a Deed of Trust described below. The sale will be made, but without covenant or warranty, expressed or implied, regarding title, possession, or encumbrances, to pay the remaining principal sum of the note(s) secured by the Deed of Trust, with interest and late charges thereon, as provided in the note(s), advances, under the terms of the Deed of Trust, interest thereon, fees, charges and expenses of the Trustee for the total amount (at the time of the initial publication of the Notice of Sale) reasonably estimated to be set forth below. The amount may be greater on the day of sale. BENEFICIARY MAY ELECT TO BID LESS THAN THE TOTAL AMOUNT DUE. Trustor: Kenneth D Doyle And Maria Doyle, Husband And Wife, As Joint Tenants Duly Appointed Trustee: Carrington Foreclosure Services, LLC Recorded 7/6/2022 as Instrument No. 2022-0302723 in book , page of Official Records in the office of the Recorder of Riverside County, California , Described as follows: As more fully described in said Deed of Trust And CrossCollateralization and CrossDefault Agreement date 6/10/2022 and Guaranty dated 6/10/2022, and Loan Modification and Extension Agreement dated 6/10/2023, Date of Sale: 7/3/2024 at 9:00 AM Place of Sale: At the front steps to the entrance of the former Corona Police Department located at 849 West Sixth Street, Corona, CA 92882 Amount of unpaid balance and other charges: $991,935.33 (Estimated) Street Address or other common designation of real property: 30381 Canyon Point Circle Menifee, California 92584 A.P.N.: 360-680-046 The undersigned Trustee disclaims any liability for any incorrectness of the street address or other common designation, if any, shown above. If no street address or other common designation is shown, directions to the location of the property may be obtained by sending a written request to the beneficiary within 10 days of the date of first publication of this Notice of Sale. If the Trustee is unable to convey title for any reason, the successful bidder’s sole and exclusive remedy shall be the return of monies paid to the Trustee, and the successful bidder shall have no further recourse. If the sale is set aside for any reason, the Purchaser at the sale shall be entitled only to a return of the deposit paid. The Purchaser shall have no further recourse against the Mortgagor, the Mortgagee, or the Mortgagee’s Attorney. If you have previously been discharged through bankruptcy, you may have been released of personal liability for this loan in which case this letter is intended to exercise the note holder’s rights against the real property only. THIS NOTICE IS SENT FOR THE PURPOSE OF COLLECTING A DEBT. THIS FIRM IS ATTEMPTING TO COLLECT A DEBT ON BEHALF OF THE HOLDER AND OWNER OF THE NOTE. ANY INFORMATION OBTAINED BY OR PROVIDED TO THIS FIRM OR THE CREDITOR WILL BE USED FOR THAT PURPOSE. As required by law, you are hereby notified that a negative credit report reflecting on your credit record may be submitted to a credit report agency if you fail to fulfill the terms of your credit obligations. NOTICE TO POTENTIAL BIDDERS: If you are considering bidding on this property lien, you should understand that there are risks involved in bidding at a trustee auction. You will be bidding on a lien, not on the property itself. Placing the highest bid at a trustee auction does not automatically entitle you to free and clear ownership of the property. You should also be aware that the lien being auctioned off may be a junior lien. If you are the highest bidder at the auction, you are or may be responsible for paying off all liens senior to the lien being auctioned off, before you can receive clear title to the property. You are encouraged to investigate the existence, priority, and size of outstanding liens that may exist on this property by contacting the county recorder’s office or a title insurance company, either of which may charge you a fee for this information. If you consult either of these resources, you should be aware that the same lender may hold more than one mortgage or deed of trust on the property. NOTICE TO PROPERTY OWNER: The sale date shown on this notice of sale may be postponed one or more times by the mortgagee, beneficiary, trustee, or a court, pursuant to Section 2924g of the California Civil Code. The law requires that information about trustee sale postponements be made available to you and to the public, as a courtesy to those not present at the sale. If you wish to learn whether your sale date has been postponed, and, if applicable, the rescheduled time and date for the sale of this property, you may call (844) 477-7869 or visit this Internet Web site www.STOXPOSTING.com, using the file number assigned to this case 24-30729. Information about postponements that are very short in duration or that occur close in time to the scheduled sale may not immediately be reflected in the telephone information or on the Internet Web site. The best way to verify postponement information is to attend the scheduled sale. For sales conducted after January 1, 2021: NOTICE TO TENANT: You may have a right to purchase this property after the trustee auction pursuant to Section 2924m of the California Civil Code. If you are an “eligible tenant buyer,” you can purchase the property if you match the last and highest bid placed at the trustee auction. If you are an “eligible bidder,” you may be able to purchase the property if you exceed the last and highest bid placed at the trustee auction. There are three steps to exercising this right of purchase. First, 48 hours after the date of the trustee sale, you can call (844) 477-7869, or visit this internet website www.STOXPOSTING.com, using the file number assigned to this case 24-30729 to find the date on which the trustee’s sale was held, the amount of the last and highest bid, and the address of the trustee. Second, you must send a written notice of intent to place a bid so that the trustee receives it no more than 15 days after the trustee’s sale. Third, you must submit a bid so that the trustee receives it no more than 45 days after the trustee’s sale. If you think you may qualify as an “eligible tenant buyer” or “eligible bidder,” you should consider contacting an attorney or appropriate real estate professional immediately for advice regarding this potential right to purchase. Date: 05/30/2024 Carrington Foreclosure Services, LLC 1600 South Douglass Road, Suite 140 Anaheim, CA 92806 Automated Sale Information: (844) 477-7869 or www.STOXPOSTING.com for NONSALE information: 888-313-1969 Tai Alailima, Director – Foreclosure Svcs

SchId:12514 AdId:4434 CustId:4

File No.: R-202406914

FICTITIOUS BUSINESS NAME STATEMENT

THE FOLLOWING PERSON(S) IS (ARE)

DOING BUSINESS AS:

- MAIC MOTOR STAR

4510 AMBER RIDGE LANE, HEMET, CA 92545

RIVERSIDE COUNTY

Full Name of Registrant: - MARCO ANTONIO ILLESCAS 4510 AMBER RIDGE LANE HEMET, CA 92545

This Business is conducted by: INDIVIDUAL.

The registrant commenced to transact business under the fictitious business name or names listed above on: N/A.

I declare that all information in this statement is true and correct. (A registrant who declares information as true any material matter pursuant to Section 17913 of Business and Professions Code that the registrant knows to be false is guilty of a misdemeanor punishable by a fine not to exceed one thousand dollars ($1,000).)

/S/MARCO ANTONIO ILLESCAS

NOTICE – In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in residence address or registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under Federal, State, or Common Law (see section 14411 ET SEQ., Business and Professions Code).

THIS STATEMENT WAS FILED WITH THE COUNTY CLERK OF RIVERSIDE ON 5/28/2024.

PETER ALDANA

SchId:12520 AdId:4437 CustId:11

SUMMONS

CASE NO. CVMV2302452

NOTICE TO DEFENDANT (AVISO AL DEMANDADO): BENIGNO AVILA CHIHUAHUA, an individual; and DOES 1 to 5, inclusive

YOU ARE BEING SUED BY PLAINTIFF (LO ESTA DEMANDANDO EL DEMANDANTE): LENDMARK FINANCIAL SERVICES, LLC, a limited liability company

NOTICE! You have been sued. The court may decide against you without your being heard unless you respond within 30 days. Read the information below.

You have 30 CALENDAR DAYS after this summons and legal papers are served on you to file a written response at this court and have a copy served on the plaintiff. A letter or phone call will not protect you. Your written response must be in proper legal form if you want the court to hear your case. There may be a court form that you can use for your response. You can find these court forms and more information at the California Courts Online SelfHelp Center (www.courtinfo.ca.gov/selfhelp), your county law library or the courthouse nearest you. If you cannot pay the filing fee, ask the court clerk for a fee waiver form. If you do not file your response on time, you may lose the case by default, and your wages, money and property may be taken without further warning from the court.

There are other legal requirements. You may want to call an attorney right away. If you do not know an attorney, you may want to call an attorney referral service. If you cannot afford an attorney, you may be eligible for free legal services from a nonprofit legal services program. You can locate these nonprofit groups at the California Legal Services Web site (www.lawhelpcalifornia.org), the California Courts Online SelfHelp Center (www.courtinfo.ca.gov/selfhelp), or by contacting your local court or county bar association. NOTE: The court has a statutory lien for waived fees and costs on any settlement or arbitration award of $10,000 or more in a civil case. The court’s lien must be paid before the court will dismiss the case.

!AVISO!: Lo han demandado. Si no responde dentro de 30 dias, la corte puede decidir en su contra sin escuchar su version. Lea la informacion a continuacion. Tiene 30 DIAS DE CALENDARIO despues de que le entreguen esta citacion y papales legales para presentar una respuesta por escrito en esta corte y hacer que se entregue una copia al demandante. Una carta o una llamada telefonica no lo protegen. Su repuesta por escrito tiene que estar en formato legal correcto si desea que procesen su caso en la corte. Es posible que haya un formulario que usted pueda usar para su repuesta. Puede encontrar estos formularios de la corte y mas informacion en el Centro de Ayuda de las Cortes de California, (www.sucorte.ca.gov) en la biblioteca de leyes de su condado o en la corte que le quede mas cerca. Si no puede pagar la cuota de presentacion, pida al secretario de la corte que le de un formulario de exencion de pago de cuotas. Si no presenta su respuesta a tiempo, puede perder el caso por incumplimiento y la corte le podra quitar su sueldo, dinero y bienes sin mas advertencia.

Hay otros requisitos legales. Es recomendable que llame a un abogado inmediatamente. Si no conoce a un abogado, puede llamar a un servicio de remision a abogados. Si no puede pagar a un abogado, es posible que cumpia con los requisitos para obtener servicios legales gratuitos de un programa de servicios legales sin fines de lucro. Puede encontrar estos grupos sin fines de lucro en el sitio web de California Legal Services (www.lawhelpcalifornia.org), en el Centro de Ayuda de las Cortes de California (www.sucorte.ca.gov), o poniendose en contacto con la corte o el colegio de abogados locales. AVISO: Por ley, la corte tiene derecho a reclamar las cuotas y los costos exentos por imponer un gravamen sobre cualquier recuperacion de $10,000 o mas de valor recibida mediante un acuerdo o una concesion de arbitraje en un caso de derecho civil. Tiene que pagar el gravamen de la corte antes de que la corte pueda desechar el caso.

The name and address of the court is:

(El nombre y dirección de la corte es): Riverside Superior Court

Superior Court of California – County of Riverside

13800 HEACOCK ST. D201 (2ND FL)

MORENO VALLEY, CA 92553

The name, address and telephone number of plaintiff’s attorney or plaintiff without an attorney, is (El nombre, la direccion y el numero de telefono del abogado del demandante, o del demandante que no tiene abogado, es):

Donald T. Dunning (144665) James MacLeod (249145)

THE DUNNING LAW FIRM APC

California DFPI Debt Collector License # 10059-99

9619 Chesapeake Dr.,

Suite 210,

San Diego, CA 92123

(858) 974-7600

Date: 5/16/2023

W. SAMUEL HAMRICK, JR.

SchId:12534 AdId:4444 CustId:239

File No.: R-202407022

FICTITIOUS BUSINESS NAME STATEMENT

THE FOLLOWING PERSON(S) IS (ARE)

DOING BUSINESS AS:

- BENTLEY HOUSE

11350 BENTLEY ST, RIVERSIDE , CA 92505

RIVERSIDE COUNTY

Full Name of Registrant: - GREGORY HIRST P.O. Box 20045, RIVERSIDE, CA 92516

- MARCEE HIRST P.O. Box 20045, RIVERSIDE, CA 92516

This Business is conducted by: MARRIED COUPLE.

The registrant commenced to transact business under the fictitious business name or names listed above on: 5/1/1998.

I declare that all information in this statement is true and correct. (A registrant who declares information as true any material matter pursuant to Section 17913 of Business and Professions Code that the registrant knows to be false is guilty of a misdemeanor punishable by a fine not to exceed one thousand dollars ($1,000).)

/S/GREGORY HIRST

NOTICE – In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in residence address or registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under Federal, State, or Common Law (see section 14411 ET SEQ., Business and Professions Code).

THIS STATEMENT WAS FILED WITH THE COUNTY CLERK OF RIVERSIDE ON 5/29/2024.

PETER ALDANA

SchId:12538 AdId:4445 CustId:11

File No.: R-202407023

FICTITIOUS BUSINESS NAME STATEMENT

THE FOLLOWING PERSON(S) IS (ARE)

DOING BUSINESS AS:

- GREENTREE HOUSE

11752 TILDEN PLACE, RIVERSIDE, CA 92505

RIVERSIDE COUNTY

Full Name of Registrant: - GREGORY HIRST P.O. BOX 20045, RIVERSIDE, CA 92516

- MARCEE HIRST P.O. BOX 20045, RIVERSIDE, CA 92516

This Business is conducted by: MARRIED COUPLE.

The registrant commenced to transact business under the fictitious business name or names listed above on: 06/01/1999.

I declare that all information in this statement is true and correct. (A registrant who declares information as true any material matter pursuant to Section 17913 of Business and Professions Code that the registrant knows to be false is guilty of a misdemeanor punishable by a fine not to exceed one thousand dollars ($1,000).)

/S/GREGORY HIRST

NOTICE – In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in residence address or registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under Federal, State, or Common Law (see section 14411 ET SEQ., Business and Professions Code).

THIS STATEMENT WAS FILED WITH THE COUNTY CLERK OF RIVERSIDE ON 5/29/2024.

PETER ALDANA

SchId:12542 AdId:4446 CustId:11

File No.: R-202407024

FICTITIOUS BUSINESS NAME STATEMENT

THE FOLLOWING PERSON(S) IS (ARE)

DOING BUSINESS AS:

- TILDEN HOUSE

11966 TILDEN PLACE, RIVERSIDE, CA 92505

RIVERSIDE COUNTY

Full Name of Registrant: - GREGORY HIRST P.O. BOX 20045, RIVERSIDE, CA 92516

- MARCEE HIRST P.O. BOX 20045, RIVERSIDE, CA 92516

This Business is conducted by: MARRIED COUPLE.

The registrant commenced to transact business under the fictitious business name or names listed above on: 6/1/2000.

I declare that all information in this statement is true and correct. (A registrant who declares information as true any material matter pursuant to Section 17913 of Business and Professions Code that the registrant knows to be false is guilty of a misdemeanor punishable by a fine not to exceed one thousand dollars ($1,000).)

/S/GREGORY HIRST

NOTICE – In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in residence address or registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under Federal, State, or Common Law (see section 14411 ET SEQ., Business and Professions Code).

THIS STATEMENT WAS FILED WITH THE COUNTY CLERK OF RIVERSIDE ON 5/29/2024.

PETER ALDANA

SchId:12546 AdId:4447 CustId:11

File No.: R-202407025

FICTITIOUS BUSINESS NAME STATEMENT

THE FOLLOWING PERSON(S) IS (ARE)

DOING BUSINESS AS:

- NORTHSTAR RESOURCES

3751 MERCED DR. SUITE F, RIVERSIDE, CA 92503

RIVERSIDE COUNTY

Full Name of Registrant: - GREGORY HIRST P.O. BOX 20045, RIVERSIDE , CA 92516

- MARCEE HIRST P.O. BOX 20045, RIVERSIDE, CA 92516

This Business is conducted by: MARRIED COUPLE.

The registrant commenced to transact business under the fictitious business name or names listed above on: 05/01/1998.

I declare that all information in this statement is true and correct. (A registrant who declares information as true any material matter pursuant to Section 17913 of Business and Professions Code that the registrant knows to be false is guilty of a misdemeanor punishable by a fine not to exceed one thousand dollars ($1,000).)

/S/GREGORY HIRST

NOTICE – In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in residence address or registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under Federal, State, or Common Law (see section 14411 ET SEQ., Business and Professions Code).

THIS STATEMENT WAS FILED WITH THE COUNTY CLERK OF RIVERSIDE ON 5/29/2024.

PETER ALDANA

SchId:12550 AdId:4448 CustId:11

NOTICE OF PETITION TO ADMINISTER ESTATE OF DARLENE MORRIS

Case No. PRRI2401354

To all heirs, beneficiaries, creditors, contingent creditors, and persons who may otherwise be interested in the will or estate, or both, of DARLENE MORRIS

A PETITION FOR PROBATE has been filed by Duwana Morris in the Superior Court of California, County of RIVERSIDE.

THE PETITION FOR PROBATE requests that Duwana Morris be appointed as personal representative to administer the estate of the decedent.

THE PETITION requests authority to administer the estate under the Independent Administration of Estates Act. (This authority will allow the personal representative to take many actions without obtaining court approval. Before taking certain very important actions, however, the personal representative will be required to give notice to interested persons unless they have waived notice or consented to the proposed action.) The independent administration authority will be granted unless an interested person files an objection to the petition and shows good cause why the court should not grant the authority.

A HEARING on the petition will be held on July 1, 2024 at 8:30 AM in Dept. No. 12 located at 4050 Main St., Riverside, CA 92501.

IF YOU OBJECT to the granting of the petition, you should appear at the hearing and state your objections or file written objections with the court before the hearing. Your appearance may be in person or by your attorney.

IF YOU ARE A CREDITOR or a contingent creditor of the decedent, you must file your claim with the court and mail a copy to the personal representative appointed by the court within the later of either (1) four months from the date of first issuance of letters to a general personal representative, as defined in section 58(b) of the California Probate Code, or (2) 60 days from the date of mailing or personal delivery to you of a notice under section 9052 of the California Probate Code.

Other California statutes and legal authority may affect your rights as a creditor. You may want to consult with an attorney knowledgeable in California law.

YOU MAY EXAMINE the file kept by the court. If you are a person interested in the estate, you may file with the court a Request for Special Notice (form DE-154) of the filing of an inventory and appraisal of estate assets or of any petition or account as provided in Probate Code section 1250. A Request for Special Notice form is available from the court clerk.

Attorney for petitioner:

ABRAHAM APRAKU ESQ

SBN 263656

LAW OFFICE OF

ABRAHAM APRAKU

2570 CORPORATE PL

STE E203

MONTEREY PARK CA 91754

CN107475 MORRIS Jun 7,14,21, 2024

SchId:12565 AdId:4454 CustId:22

Order To Show Cause For Change of Name

Case No. CVMV2403934

To All Interested Persons: Maria Guadalupe Mendoza

filed a petition with this court for a decree changing names as follows:

1 PRESENT NAME:

Maria Guadalupe Mendoza

PROPOSED NAME:

Maria Mālie Guadalupe Mendoza

The Court Orders that all persons interested in this matter shall appear before this court at the hearing indicated below to show cause, if any, why the petition for change of name should not be granted. Any person objecting to the name changes described above must file a written objection that includes the reasons for the objection at least two court days before the matter is scheduled to be heard and must appear at the hearing to show cause why the petition should not be granted. If no written objection is timely filed, the court may grant the petition without a hearing.

Notice Of Hearing

Date: 7/17/2024 Time: 8:00 AM Dept. MV2. The address of the court is Superior Court of Riverside, 13800 Heacock Avenue BLDG D #201, Moreno Valley CA 92553-3338. A copy of this Order to Show Cause shall be published at least once each week for four successive weeks prior to the date set for hearing on the petition in the following newspaper of general circulation, printed in this county: The Perris Progress

County of Riverside

Date: 05/30/2024

W. SAMUEL HAMRICK, JR.

Riverside Superior Court

SchId:12579 AdId:4458 CustId:17

Order To Show Cause For Change of Name

Case No. CVSW2405905

To All Interested Persons: Cassandra L. Fontenette

filed a petition with this court for a decree changing names as follows:

1 PRESENT NAME:

Kamryn Tyler Yocum

PROPOSED NAME:

Kamryn Tyler Fontenette

The Court Orders that all persons interested in this matter shall appear before this court at the hearing indicated below to show cause, if any, why the petition for change of name should not be granted. Any person objecting to the name changes described above must file a written objection that includes the reasons for the objection at least two court days before the matter is scheduled to be heard and must appear at the hearing to show cause why the petition should not be granted. If no written objection is timely filed, the court may grant the petition without a hearing.

Notice Of Hearing

Date: 10/24/2024 Time: 8:00 AM Dept. S101. The address of the court is Superior Court of Riverside, 30755-D Auld Road, Murrieta, CA 92563. A copy of this Order to Show Cause shall be published at least once each week for four successive weeks prior to the date set for hearing on the petition in the following newspaper of general circulation, printed in this county: The Perris Progress

County of Riverside

Date: 06/07/2024

W. SAMUEL HAMRICK, JR.

Riverside Superior Court

SchId:12629 AdId:4476 CustId:136

File No.: R-202407396

FICTITIOUS BUSINESS NAME STATEMENT

THE FOLLOWING PERSON(S) IS (ARE)

DOING BUSINESS AS:

- FRANMEL TRUCKING

1815 BANKSTOWN WAY, PERRIS, CA 92571

RIVERSIDE COUNTY

Full Name of Registrant: - FRANK — HERNANDEZ 1815 BANKSTOWN WAY PERRIS, CA 92571

This Business is conducted by: INDIVIDUAL.

The registrant commenced to transact business under the fictitious business name or names listed above on: N/A.

I declare that all information in this statement is true and correct. (A registrant who declares information as true any material matter pursuant to Section 17913 of Business and Professions Code that the registrant knows to be false is guilty of a misdemeanor punishable by a fine not to exceed one thousand dollars ($1,000).)

/S/FRANK HERNANDEZ

NOTICE – In accordance with subdivision (a) of Section 17920, a fictitious name statement generally expires at the end of five years from the date on which it was filed in the office of the county clerk, except, as provided in subdivision section 17920, where it expires 40 days after any change in the facts set forth in the statement pursuant to section 17913 other than a change in residence address or registered owner. A new fictitious business name statement must be filed before the expiration. The filing of this statement does not of itself authorize the use in this state of a fictitious business name in violation of the rights of another under Federal, State, or Common Law (see section 14411 ET SEQ., Business and Professions Code).

THIS STATEMENT WAS FILED WITH THE COUNTY CLERK OF RIVERSIDE ON 6/6/2024.

PETER ALDANA

SchId:12633 AdId:4477 CustId:11

Loan No.: EWL6774 – Montoya TS no. 2023-10901 APN: 335-471-024 NOTICE OF TRUSTEE’S SALE UNDER DEED OF TRUST YOU ARE IN DEFAULT UNDER A DEED OF TRUST, DATED 10/31/2022, UNLESS YOU TAKE ACTION TO PROTECT YOUR PROPERTY, IT MAY BE SOLD AT A PUBLIC SALE. IF YOU NEED AN EXPLANATION OF THE NATURE OF THE PROCEEDING AGAINST YOU, YOU SHOULD CONTACT A LAWYER. NOTICE IS HEREBY GIVEN, that on 7/9/2024, at 9:00 AM of said day, At the bottom of the stairway to the building located at 849 W. Sixth Street, Corona, CA 92882, Ashwood TD Services LLC, a California Limited Liability Company, as duly appointed Trustee under and pursuant to the power of sale conferred in that certain Deed of Trust executed by Samuel A. Montoya, a widower recorded on 11/7/2022 in Book n/a of Official Records of RIVERSIDE County, at page n/a, Recorder’s Instrument No. 2022-0462676, by reason of a breach or default in payment or performance of the obligations secured thereby, including that breach or default, Notice of which was recorded 12/14/2023 as Recorder’s Instrument No. 2023-0371144, in Book n/a, at page n/a, WILL SELL AT PUBLIC AUCTION TO THE HIGHEST BIDDER FOR CASH, lawful money of the United States, evidenced by a Cashier’s Check drawn on a state or national bank, or the equivalent thereof drawn on any other financial institution specified in section 5102 of the California Financial Code, authorized to do business in the State of California, ALL PAYABLE AT THE TIME OF SALE, all right, title and interest held by it as Trustee, in that real property situated in said County and State, described as follows: Lot 52, Tract 28504-2, per Map, Book 359, Pages 17 through 21, inclusive of Maps. The street address or other common designation of the real property hereinabove described is purported to be: 25587 Mountain Glen Circle, Menifee, CA 92585. The undersigned disclaims all liability for any incorrectness in said street address or other common designation. Said sale will be made without warranty, express or implied regarding title, possession, or other encumbrances, to satisfy the unpaid obligations secured by said Deed of Trust, with interest and other sums as provided therein; plus advances, if any, thereunder and interest thereon; and plus fees, charges, and expenses of the Trustee and of the trusts created by said Deed of Trust. The total amount of said obligations at the time of initial publication of this Notice is $133,015.81. In the event that the deed of trust described in this Notice of Trustee’s Sale is secured by real property containing from one to four singlefamily residences, the following notices are provided pursuant to the provisions of Civil Code section 2924f: NOTICE TO POTENTIAL BIDDERS: If you are considering bidding on this property lien, you should understand that there are risks involved in bidding at a trustee auction. You will be bidding on a lien, not on the property itself. Placing the highest bid at a trustee auction does not automatically entitle you to free and clear ownership of the property. You should also be aware that the lien being auctioned off may be a junior lien. If you are the highest bidder at the auction, you are or may be responsible for paying off all liens senior to the lien being auctioned off, before you can receive clear title to the property. You are encouraged to investigate the existence, priority, and size of outstanding liens that may exist on this property by contacting the county recorder’s office or a title insurance company, either of which may charge you a fee for this information. If you consult either of these resources, you should be aware that the same lender may hold more than one mortgage or deed of trust on the property. NOTICE TO PROPERTY OWNER: The sale date shown on this notice of sale may be postponed one or more times by the mortgagee, beneficiary, trustee, or a court, pursuant to Section 2924g of the California Civil Code. The law requires that information about trustee’s sale postponements be made available to you and to the public, as a courtesy to those not present at the sale. If you wish to learn whether your sale date has been postponed, and, if applicable, the rescheduled time and date for the sale of this property, you may call 916-939-0772 or visit this internet website www.nationwideposting.com, using the file number assigned to this case 2023-10901. Information about postponements that are very short in duration or that occur close in time to the scheduled sale may not be immediately reflected in the telephone information or on the internet website. The best way to verify postponement information is to attend the scheduled sale. NOTICE TO TENANT: You may have a right to purchase this property after the trustee auction pursuant to Section 2924m of the California Civil Code. If you are an “eligible tenant buyer,” you can purchase the property if you match the last and highest bid placed at the trustee auction. If you are an “eligible bidder,” you may be able to purchase the property if you exceed the last and highest bid placed at the trustee auction. There are three steps to exercising this right of purchase. First, 48 hours after the date of the trustee sale, you can call 916-939-0772, or visit this internet website www.nationwideposting.com, using the file number assigned to this case 2023-10901 to find the date on which the trustee’s sale was held, the amount of the last and highest bid, and the address of the trustee. Second, you must send a written notice of intent to place a bid so that the trustee receives it no more than 15 days after the trustee’s sale. Third, you must submit a bid, by remitting the funds and affidavit or declaration described in Section 2924m(c) of the Civil Code, so that the trustee receives it no more than 45 days after the trustee’s sale. If you think you may qualify as an “eligible tenant buyer” or “eligible bidder,” you should consider contacting an attorney or appropriate real estate professional immediately for advice regarding this potential right to purchase. Dated: June 11, 2024 Ashwood TD Services LLC, a California Limited Liability Company Christopher Loria, Trustee’s Sale Officer 231 E. Alessandro Blvd., Ste. 6A-693, Riverside, CA 92508 Tel.: (951) 215-0069 Fax: (805) 323-9054 Trustee’s Sale Information: (916) 939-0772 or www.nationwideposting.com NPP0461767 To: PERRIS PROGRESS 06/14/2024, 06/21/2024, 06/28/2024

SchId:12643 AdId:4480 CustId:1

T.S. No. 121811-CA APN: 333-690-031 NOTICE OF TRUSTEE’S SALE IMPORTANT NOTICE TO PROPERTY OWNER: YOU ARE IN DEFAULT UNDER A DEED OF TRUST, DATED 8/20/2019. UNLESS YOU TAKE ACTION TO PROTECT YOUR PROPERTY, IT MAY BE SOLD AT A PUBLIC SALE. IF YOU NEED AN EXPLANATION OF THE NATURE OF THE PROCEEDING AGAINST YOU, YOU SHOULD CONTACT A LAWYER On 7/17/2024 at 9:00 AM, CLEAR RECON CORP, as duly appointed trustee under and pursuant to Deed of Trust recorded 8/22/2019 as Instrument No. 2019-0324380 the subject Deed of Trust was modified by Loan Modification recorded on 01/07/2022 as Instrument 2022-0011135 of Official Records in the office of the County Recorder of Riverside County, State of CALIFORNIA executed by: CHASE BORNINKHOF, A MARRIED MAN AS HIS SOLE AND SEPARATE PROPERTY WILL SELL AT PUBLIC AUCTION TO HIGHEST BIDDER FOR CASH, CASHIER’S CHECK DRAWN ON A STATE OR NATIONAL BANK, A CHECK DRAWN BY A STATE OR FEDERAL CREDIT UNION, OR A CHECK DRAWN BY A STATE OR FEDERAL SAVINGS AND LOAN ASSOCIATION, SAVINGS ASSOCIATION, OR SAVINGS BANK SPECIFIED IN SECTION 5102 OF THE FINANCIAL CODE AND AUTHORIZED TO DO BUSINESS IN THIS STATE; In front of the Corona Civic Center, 849 W. Sixth Street, Corona, CA 92882 all right, title and interest conveyed to and now held by it under said Deed of Trust in the property situated in said County and State described as: MORE ACCURATELY DESCRIBED IN SAID DEED OF TRUST. The street address and other common designation, if any, of the real property described above is purported to be: 28712 MAHOGANY TRAIL WAY, MENIFEE, CA 92584 The undersigned Trustee disclaims any liability for any incorrectness of the street address and other common designation, if any, shown herein. Said sale will be held, but without covenant or warranty, express or implied, regarding title, possession, condition, or encumbrances, including fees, charges and expenses of the Trustee and of the trusts created by said Deed of Trust, to pay the remaining principal sums of the note(s) secured by said Deed of Trust. The total amount of the unpaid balance of the obligation secured by the property to be sold and reasonable estimated costs, expenses and advances at the time of the initial publication of the Notice of Sale is: $385,883.30 If the Trustee is unable to convey title for any reason, the successful bidder’s sole and exclusive remedy shall be the return of monies paid to the Trustee, and the successful bidder shall have no further recourse. The beneficiary under said Deed of Trust heretofore executed and delivered to the undersigned a written Declaration of Default and Demand for Sale, and a written Notice of Default and Election to Sell. The undersigned or its predecessor caused said Notice of Default and Election to Sell to be recorded in the county where the real property is located. NOTICE TO POTENTIAL BIDDERS: If you are considering bidding on this property lien, you should understand that there are risks involved in bidding at a trustee auction. You will be bidding on a lien, not on the property itself. Placing the highest bid at a trustee auction does not automatically entitle you to free and clear ownership of the property. You should also be aware that the lien being auctioned off may be a junior lien. If you are the highest bidder at the auction, you are or may be responsible for paying off all liens senior to the lien being auctioned off, before you can receive clear title to the property. You are encouraged to investigate the existence, priority, and size of outstanding liens that may exist on this property by contacting the county recorder’s office or a title insurance company, either of which may charge you a fee for this information. If you consult either of these resources, you should be aware that the same lender may hold more than one mortgage or deed of trust on the property. NOTICE TO PROPERTY OWNER: The sale date shown on this notice of sale may be postponed one or more times by the mortgagee, beneficiary, trustee, or a court, pursuant to Section 2924g of the California Civil Code. The law requires that information about trustee sale postponements be made available to you and to the public, as a courtesy to those not present at the sale. If you wish to learn whether your sale date has been postponed, and, if applicable, the rescheduled time and date for the sale of this property, you may call (855) 313-3319 or visit this Internet website www.clearreconcorp.com, using the file number assigned to this case 121811-CA. Information about postponements that are very short in duration or that occur close in time to the scheduled sale may not immediately be reflected in the telephone information or on the Internet Web site. The best way to verify postponement information is to attend the scheduled sale. NOTICE TO TENANT: Effective January 1, 2021, you may have a right to purchase this property after the trustee auction pursuant to Section 2924m of the California Civil Code. If you are an “eligible tenant buyer,” you can purchase the property if you match the last and highest bid placed at the trustee auction. If you are an “eligible bidder,” you may be able to purchase the property if you exceed the last and highest bid placed at the trustee auction. There are three steps to exercising this right of purchase. First, 48 hours after the date of the trustee sale, you can call (855) 313-3319, or visit this internet website www.clearreconcorp.com, using the file number assigned to this case 121811-CA to find the date on which the trustee’s sale was held, the amount of the last and highest bid, and the address of the trustee. Second, you must send a written notice of intent to place a bid so that the trustee receives it no more than 15 days after the trustee’s sale. Third, you must submit a bid so that the trustee receives it no more than 45 days after the trustee’s sale. If you think you may qualify as an “eligible tenant buyer” or “eligible bidder,” you should consider contacting an attorney or appropriate real estate professional immediately for advice regarding this potential right to purchase. FOR SALES INFORMATION: (800) 758-8052 CLEAR RECON CORP 3333 Camino Del Rio South, Suite 225 San Diego, California 92108

SchId:12649 AdId:4482 CustId:4

T.S. No.: 2024-00086-CA A.P.N.:329340005

Property Address: 28080 ELLER WAY, ROMOLAND AREA, CA 92585

NOTICE OF TRUSTEE’S SALE

PURSUANT TO CIVIL CODE § 2923.3(a) and (d), THE SUMMARY OF INFORMATION REFERRED TO BELOW IS NOT ATTACHED TO THE RECORDED COPY OF THIS DOCUMENT BUT ONLY TO THE COPIES PROVIDED TO THE TRUSTOR.

NOTE: THERE IS A SUMMARY OF THE INFORMATION IN THIS DOCUMENT ATTACHED

注:本文件包含一个信息摘要

참고사항: 본 첨부 문서에 정보 요약서가 있습니다

NOTA: SE ADJUNTA UN RESUMEN DE LA INFORMACIÓN DE ESTE DOCUMENTO

TALA: MAYROONG BUOD NG IMPORMASYON SA DOKUMENTONG ITO NA NAKALAKIP

LƯU Ý: KÈM THEO ĐÂY LÀ BẢN TRÌNH BÀY TÓM LƯỢC VỀ THÔNG TIN TRONG TÀI LIỆU NÀY

IMPORTANT NOTICE TO PROPERTY OWNER:

YOU ARE IN DEFAULT UNDER A DEED OF TRUST DATED 12/07/2005. UNLESS YOU TAKE ACTION TO PROTECT YOUR PROPERTY, IT MAY BE SOLD AT A PUBLIC SALE. IF YOU NEED AN EXPLANATION OF THE NATURE OF THE PROCEEDING AGAINST YOU, YOU SHOULD CONTACT A LAWYER.

Trustor: Juana Malvadez, A Single Woman

Duly Appointed Trustee: Western Progressive, LLC

Deed of Trust Recorded 12/15/2005 as Instrument No. 2005-1036794 in book —, page— and further modified by that certain Modification Agreement recorded on 02/24/2010, as Instrument No. 2010-0082709 of Official Records in the office of the Recorder of Riverside County, California,

Date of Sale: 07/24/2024 at 09:30 AM

Place of Sale: THE BOTTOM OF THE STAIRWAY TO THE BUILDING LOCATED AT 849 W. SIXTH STREET, CORONA, CA 92882

Estimated amount of unpaid balance, reasonably estimated costs and other charges: $ 273,552.20

NOTICE OF TRUSTEE’S SALE

THE TRUSTEE WILL SELL AT PUBLIC AUCTION TO HIGHEST BIDDER FOR CASH, CASHIER’S CHECK DRAWN ON A STATE OR NATIONAL BANK, A CHECK DRAWN BY A STATE OR FEDERAL CREDIT UNION, OR A CHECK DRAWN BY A STATE OR FEDERAL SAVINGS AND LOAN ASSOCIATION, A SAVINGS ASSOCIATION OR SAVINGS BANK SPECIFIED IN SECTION 5102 OF THE FINANCIAL CODE AND AUTHORIZED TO DO BUSINESS IN THIS STATE:

All right, title, and interest conveyed to and now held by the trustee in the hereinafter described property under and pursuant to a Deed of Trust described as:

More fully described in said Deed of Trust.

Street Address or other common designation of real property: 28080 ELLER WAY, ROMOLAND AREA, CA 92585

A.P.N.: 329340005

The undersigned Trustee disclaims any liability for any incorrectness of the street address or other common designation, if any, shown above.

The sale will be made, but without covenant or warranty, expressed or implied, regarding title, possession, or encumbrances, to pay the remaining principal sum of the note(s) secured by the Deed of Trust with interest thereon, as provided in said note(s), advances, under the terms of said Deed of Trust, fees, charges and expenses of the Trustee and of the trusts created by said Deed of Trust. The total amount of the unpaid balance of the obligation secured by the property to be sold and reasonable estimated costs, expenses and advances at the time of the initial publication of the Notice of Sale is:

$ 273,552.20.

Note: Because the Beneficiary reserves the right to bid less than the total debt owed, it is possible that at the time of the sale the opening bid may be less than the total debt.

If the Trustee is unable to convey title for any reason, the successful bidder’s sole and exclusive remedy shall be the return of monies paid to the Trustee, and the successful bidder shall have no further recourse.

The beneficiary of the Deed of Trust has executed and delivered to the undersigned a written request to commence foreclosure, and the undersigned caused a Notice of Default and Election to Sell to be recorded in the county where the real property is located.

NOTICE OF TRUSTEE’S SALE

NOTICE TO POTENTIAL BIDDERS: If you are considering bidding on this property lien, you should understand that there are risks involved in bidding at a trustee auction. You will be bidding on a lien, not on the property itself. Placing the highest bid at a trustee auction does not automatically entitle you to free and clear ownership of the property. You should also be aware that the lien being auctioned off may be a junior lien. If you are the highest bidder at the auction, you are or may be responsible for paying off all liens senior to the lien being auctioned off, before you can receive clear title to the property. You are encouraged to investigate the existence, priority, and size of outstanding liens that may exist on this property by contacting the county recorder’s office or a title insurance company, either of which may charge you a fee for this information. If you consult either of these resources, you should be aware that the same lender may hold more than one mortgage or deed of trust on this property.

NOTICE TO PROPERTY OWNER: The sale date shown on this notice of sale may be postponed one or more times by the mortgagee, beneficiary, trustee, or a court, pursuant to Section 2924g of the California Civil Code. The law requires that information about trustee sale postponements be made available to you and to the public, as a courtesy to those not present at the sale. If you wish to learn whether your sale date has been postponed, and, if applicable, the rescheduled time and date for the sale of this property, you may call (866)-960-8299 or visit this Internet Web site https://www.altisource.com/loginpage.aspx using the file number assigned to this case 2024-00086-CA. Information about postponements that are very short in duration or that occur close in time to the scheduled sale may not immediately be reflected in the telephone information or on the Internet Web site. The best way to verify postponement information is to attend the scheduled sale.

NOTICE OF TRUSTEE’S SALE

NOTICE TO TENANT: You may have a right to purchase this property after the trustee auction, if conducted after January 1, 2021, pursuant to Section 2924m of the California Civil Code. If you are an “eligible tenant buyer,” you can purchase the property if you match the last and highest bid placed at the trustee auction. If you are an “eligible bidder,” you may be able to purchase the property if you exceed the last and highest bid placed at the trustee auction. There are three steps to exercising this right of purchase. First, 48 hours after the date of the trustee sale, you can call (877)-518-5700, or visit this internet website https://www.realtybid.com/, using the file number assigned to this case 2024-00086-CA to find the date on which the trustee’s sale was held, the amount of the last and highest bid, and the address of the trustee. Second, you must send a written notice of intent to place a bid so that the trustee receives it no more than 15 days after the trustee’s sale. Third, you must submit a bid, by remitting the funds and affidavit described in Section 2924m(c) of the Civil Code, so that the trustee receives it no more than 45 days after the trustee’s sale. If you think you may qualify as an “eligible tenant buyer” or “eligible bidder,” you should consider contacting an attorney or appropriate real estate professional immediately for advice regarding this potential right to purchase.

Date: June 11, 2024 Western Progressive, LLC, as Trustee for beneficiary

C/o 1500 Palma Drive, Suite 238

Ventura, CA 93003

Sale Information Line: (866) 960-8299 https://www.altisource.com/loginpage.aspx

Trustee Sale Assistant

WESTERN PROGRESSIVE, LLC MAY BE ACTING AS A DEBT COLLECTOR ATTEMPTING TO COLLECT A DEBT. ANY INFORMATION OBTAINED MAY BE USED FOR THAT PURPOSE.

SchId:12672 AdId:4489 CustId:73

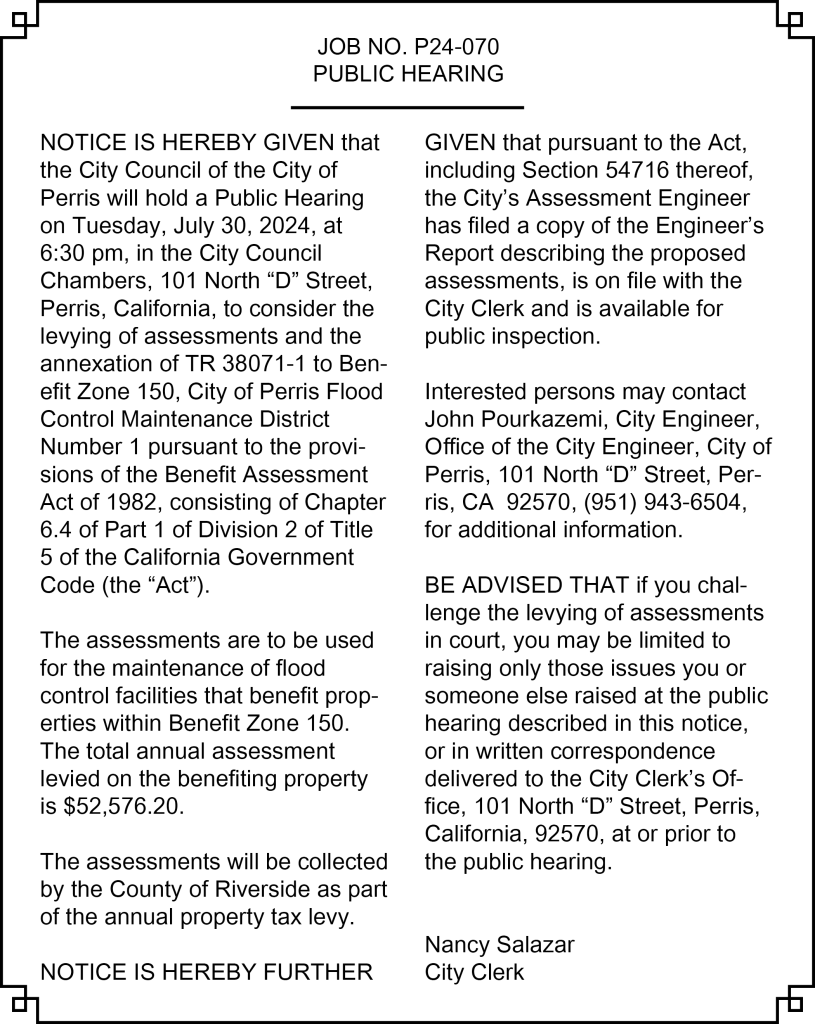

Job No. P24-067

RESOLUTION NUMBER 6419A RESOLUTION OF THE CITY COUNCIL OF THE CITY OF PERRIS, COUNTY OF RIVERSIDE, STATE OF CALIFORNIA, DECLARING INTENTION TO ORDER THE ANNEXATION TO CITY OF PERRIS MAINTENANCE DISTRICT NUMBER 84-1, DECLARING THE WORK TO BE OF MORE LOCAL THAN ORDINARY PUBLIC BENEFIT; SPECIFYING THE EXTERIOR BOUNDARIES OF THE AREA TO BE ANNEXED TO MAINTENANCE DISTRICT NUMBER 84-1 AND TO BE ASSESSED THE COST AND EXPENSE THEREOF; DESIGNATING SAID ANNEXATION AS ANNEXATION OF A PORTION OF W. 10TH STREET TO MAINTENANCE DISTRICT NUMBER 84-1; DETERMINING THAT THESE PROCEEDINGS SHALL BE TAKEN PURSUANT TO THE LANDSCAPING AND LIGHTING ACT OF 1972; AND OFFERING A TIME AND PLACE FOR HEARING OBJECTIONS THERETO ON JULY 30, 2024

WHEREAS, the City Council of the City of Perris (the “City”) has previously formed special maintenance districts pursuant to the terms of the "Landscaping and Lighting Act of 1972" (the "Act"), being Division 15, Part 2 of the Streets and Highways Code of the State of California, including the special maintenance district known and designated as MAINTENANCE DISTRICT NO. 84-1 (hereinafter referred to as the "District"); and

WHEREAS, the provisions of Article II of Chapter 2 of the Act authorize the City Council to order the annexation of territory to the District; and

WHEREAS, on the 11th day of June, 2024, the City Council of the City of Perris, County of Riverside, California ("the City Council") adopted its Resolution Number 6417 directing the Engineer of Work to prepare and file with the City Clerk of said City a report in writing as required by the Act; and

WHEREAS, said Engineer of Work has prepared and filed with the City Clerk of said City a report (the "Engineer's Report") in writing as called for in said resolution and under and pursuant to said act, which report has been presented to this City Council for consideration; and

WHEREAS, said City Council has duly considered the Engineer’s Report and each and every part thereof, and has found that each and every part of the Engineer’s Report is sufficient, and that no portion of the report requires or should be modified in any respect; and

WHEREAS, the City now desires to declare its intention to annex certain property into the District, pursuant to the Act and, more specifically, Section 22587 thereof, and to take certain other actions as required by the Act; NOW, THEREFORE, BE IT RESOLVED, by the City Council of the City of Perris, California, as follows:

Section 1. Recitals. The Recitals set forth above are true and correct and are incorporated herein by this reference.

Section 2. Description of Work: That the public interest and convenience requires and it is the intention of the City Council of the City of Perris to annex a portion of W. 10th Street to the District, and to order the following work be done, to wit:

1. Installation, construction, maintenance, and servicing of streetlight and traffic signal facilities as authorized by Section 22525 of the Streets and Highways Code, State of California.

2. Any and all work and materials appurtenant thereto or which are necessary or convenient for the maintenance and servicing thereof.

Section 3. Location of Work: The improvements to be maintained and serviced consist of the streetlights within proximity to the annexed parcels on the south side of W. 10th Street between “B” Street and Front Street.

Section 4. Description of Assessment District: That the contemplated work, in the opinion of said City Council, is of more local than ordinary public benefit, and this City Council hereby makes the expense of said work chargeable upon a District, which said District is assessed to pay the costs and expenses thereof, and which District is described as follows:All that certain territory of the City of Perris included within the exterior boundary lines shown upon that certain “Diagram of Annexation of A Portion of W. 10th Street to Maintenance District Number 84-1” heretofore approved by the City Council of said City by Resolution Number 6417, indicating by said boundary line the extent of the territory included within the proposed assessment district and which map is on file in the office of the City Clerk of said City.

Reference is hereby made to said map for a further, full, and more particular description of said assessment district, and the said map so on file shall govern for all details as to the extent of said assessment district.

Section 5. Report of Engineer: The City Council of said City by Resolution Number 6418 has preliminarily approved the report of the Engineer of Work which report indicated the amount of the proposed assessment, the district boundaries, assessment zones, detailed description of improvements, and the method of assessment. The report titled “Engineer’s Report for Annexation of a Portion of W. 10th street, to Maintenance District Number 84-1”, is on file in the office of the City Clerk of said City. Reference to said report is hereby made for all particulars for the amount and extent of the assessments and for the extent of the work.

Section 6. Collection of Assessments: The assessment shall be collected at the same time and in the same manner as taxes for the County of Riverside are collected. The Engineer of Work shall file a report annually with the City Council of said City and said City Council will annually conduct a hearing upon said report at their regular meeting before August 10th, at which time assessments for the next Fiscal Year will be determined. That the annual assessment reflecting the reasonable cost of providing for the maintenance, servicing and operation of the streetlights and traffic signals and appurtenant facilities is $47.28 per Benefit Unit (single family home). Each year the current maximum annual assessment shall be increased by an amount equal to the greater of the Consumer Price Index (“CPI”) from January to January for the RiversideSan BernardinoOntario Area for Urban Consumers, as developed by U.S. Bureau of Labor Statistics or three percent (3%). If a deficit is projected for the upcoming fiscal year, the assessment can be further increased by an amount equal to the Southern California Edison rate increase projected for the upcoming fiscal year.

Section 7. Time and Place of Public Hearing: Notice is hereby given that on July 30, 2024, at 6:30 p.m., in the City Council Chambers of the City Council of the City of Perris, California, 101 North "D" Street, in the City of Perris, State of California, is hereby fixed as the time and place for a hearing by this City Council on the question of the levying and collection of the proposed assessments. That any and all persons having any objections to the work or the extent of the annexation to the assessment district may appear and show cause why said work should not be done or carried out or why said annexation to the district should not be confirmed in accordance with this Resolution of Intention. City Council will consider all oral and written protests.

Section 8. Landscaping and Lighting Act of 1972: All the work herein proposed shall be done and carried through in pursuance of an act of the legislature of the State of California designated the Landscaping and Lighting Act of 1972, being Division 15 of the Streets and Highways Code of the State of California.

Section 9. Publication of Resolution of Intention: The City Clerk shall cause this Resolution of Intention to be published one time as required by Section 22552 of the California Streets and Highways Code, occurring no later than 10 days prior to the public hearing at which the City Council will consider levying the proposed special assessments. The published notice will encompass oneeighth of a newspaper page. The Perris Progress is hereby designated as the newspaper in which the City Clerk shall publish this Resolution of Intention. Upon completion of giving notice, the City Clerk is further directed to file in her office a proof of publication setting forth compliance with the requirements for publishing.

Section 10. Mailing of Notice: The City Clerk shall also give notice by a firstclass mailing to all owners of property subject to any new or increased assessments. The notice shall be mailed no later than 45 days prior to the public hearing at which the City Council will consider levying the new or increased assessments and shall be at least in 10-point type. The form of said notice shall conform in all respects with the requirements of subdivision (b) of Section 53753 of the Government Code and pursuant to subdivision (c) of that section, each notice shall contain an assessment ballot whereon the property owner may indicate support or opposition to the proposed assessment.

Section 11. Designation of Contact Person: That this City Council does hereby designate, John Pourkazemi, City Engineer of the City of Perris, (951) 943-6504 as the person to answer inquiries regarding the District and the proposed annexation thereto.

Section 12. Certification: The City Clerk shall certify to the adoption of this Resolution.ADOPTED, SIGNED and APPROVED this 11th day of June, 2024.

Mayor, Michael M. VargasATTEST:

City Clerk, Nancy Salazar

STATE OF CALIFORNIA )

COUNTY OF RIVERSIDE ) §

CITY OF PERRIS )

I, Nancy Salazar, CITY CLERK OF THE CITY OF PERRIS, CALIFORNIA, DO HEREBY CERTIFY that the foregoing Resolution Number 6419 was duly and regularly adopted by the City Council of the City of Perris at a regular meeting held the 11th day of June, 2024, by the following called vote:

AYES: ROGERS, NAVA, CORONA, RABB, VARGAS

NOES: NONE

ABSENT: NONE

ABSTAIN: NONE

City Clerk, Nancy SalazarSchId:12684 AdId:4494 CustId:18

Job No. P24-068

RESOLUTION NUMBER 6422A RESOLUTION OF THE CITY COUNCIL OF THE CITY OF PERRIS, COUNTY OF RIVERSIDE, STATE OF CALIFORNIA, DECLARING INTENTION TO ORDER THE ANNEXATION TO CITY OF PERRIS MAINTENANCE DISTRICT NUMBER 84-1, DECLARING THE WORK TO BE OF MORE LOCAL THAN ORDINARY PUBLIC BENEFIT; SPECIFYING THE EXTERIOR BOUNDARIES OF THE AREA TO BE ANNEXED TO MAINTENANCE DISTRICT NUMBER 84-1 AND TO BE ASSESSED THE COST AND EXPENSE THEREOF; DESIGNATING SAID ANNEXATION AS ANNEXATION OF TR 38071-1 TO MAINTENANCE DISTRICT NUMBER 84-1; DETERMINING THAT THESE PROCEEDINGS SHALL BE TAKEN PURSUANT TO THE LANDSCAPING AND LIGHTING ACT OF 1972; AND OFFERING A TIME AND PLACE FOR HEARING OBJECTIONS THERETO ON JULY 30, 2024

WHEREAS, the City Council of the City of Perris (the “City”) has previously formed special maintenance districts pursuant to the terms of the "Landscaping and Lighting Act of 1972" (the "Act"), being Division 15, Part 2 of the Streets and Highways Code of the State of California, including the special maintenance district known and designated as MAINTENANCE DISTRICT NO. 84-1 (hereinafter referred to as the "District"); and

WHEREAS, the provisions of Article II of Chapter 2 of the Act authorize the City Council to order the annexation of territory to the District; and

WHEREAS, on the 11th day of June, 2024, the City Council of the City of Perris, County of Riverside, California ("the City Council") adopted its Resolution Number 6420 directing the Engineer of Work to prepare and file with the City Clerk of said City a report in writing as required by the Act; and

WHEREAS, said Engineer of Work has prepared and filed with the City Clerk of said City a report (the "Engineer's Report") in writing as called for in said resolution and under and pursuant to said act, which report has been presented to this City Council for consideration; and

WHEREAS, said City Council has duly considered the Engineer’s Report and each and every part thereof, and has found that each and every part of the Engineer’s Report is sufficient, and that no portion of the report requires or should be modified in any respect; and

WHEREAS, the City now desires to declare its intention to annex certain property into the District, pursuant to the Act and, more specifically, Section 22587 thereof, and to take certain other actions as required by the Act; NOW, THEREFORE, BE IT RESOLVED, by the City Council of the City of Perris, California, as follows:

Section 1. Recitals. The Recitals set forth above are true and correct and are incorporated herein by this reference.

Section 2. Description of Work: That the public interest and convenience requires and it is the intention of the City Council of the City of Perris to annex TR 38071-1 to the District, and to order the following work be done, to wit:

1. Installation, construction, maintenance, and servicing of streetlight and traffic signal facilities as authorized by Section 22525 of the Streets and Highways Code, State of California.

2. Any and all work and materials appurtenant thereto or which are necessary or convenient for the maintenance and servicing thereof.

Section 3. Location of Work: The improvements to be maintained and serviced consist of the streetlights within said annexation.

Section 4. Description of Assessment District: That the contemplated work, in the opinion of said City Council, is of more local than ordinary public benefit, and this City Council hereby makes the expense of said work chargeable upon a District, which said District is assessed to pay the costs and expenses thereof, and which District is described as follows:All that certain territory of the City of Perris included within the exterior boundary lines shown upon that certain “Diagram of Annexation of TR 38071-1 to Maintenance District Number 84-1” heretofore approved by the City Council of said City by Resolution Number 6420, indicating by said boundary line the extent of the territory included within the proposed assessment district and which map is on file in the office of the City Clerk of said City.

Reference is hereby made to said map for a further, full, and more particular description of said assessment district, and the said map so on file shall govern for all details as to the extent of said assessment district.

Section 5. Report of Engineer: The City Council of said City by Resolution Number 6421 has preliminarily approved the report of the Engineer of Work which report indicated the amount of the proposed assessment, the district boundaries, assessment zones, detailed description of improvements, and the method of assessment. The report titled “Engineer’s Report for Annexation of TR 38071-1, to Maintenance District Number 84-1”, is on file in the office of the City Clerk of said City. Reference to said report is hereby made for all particulars for the amount and extent of the assessments and for the extent of the work.

Section 6. Collection of Assessments: The assessment shall be collected at the same time and in the same manner as taxes for the County of Riverside are collected. The Engineer of Work shall file a report annually with the City Council of said City and said City Council will annually conduct a hearing upon said report at their regular meeting before August 10th, at which time assessments for the next Fiscal Year will be determined. That the annual assessment reflecting the reasonable cost of providing for the maintenance, servicing and operation of the streetlights and traffic signals and appurtenant facilities is $47.28 per Benefit Unit (single family home). Each year the current maximum annual assessment shall be increased by an amount equal to the greater of the Consumer Price Index (“CPI”) from January to January for the RiversideSan BernardinoOntario Area for Urban Consumers, as developed by U.S. Bureau of Labor Statistics or three percent (3%). If a deficit is projected for the upcoming fiscal year, the assessment can be further increased by an amount equal to the Southern California Edison rate increase projected for the upcoming fiscal year.

Section 7. Time and Place of Public Hearing: Notice is hereby given that on July 30, 2024, at 6:30 p.m., in the City Council Chambers of the City Council of the City of Perris, California, 101 North "D" Street, in the City of Perris, State of California, is hereby fixed as the time and place for a hearing by this City Council on the question of the levying and collection of the proposed assessments. That any and all persons having any objections to the work or the extent of the annexation to the assessment district may appear and show cause why said work should not be done or carried out or why said annexation to the district should not be confirmed in accordance with this Resolution of Intention. City Council will consider all oral and written protests.

Section 8. Landscaping and Lighting Act of 1972: All the work herein proposed shall be done and carried through in pursuance of an act of the legislature of the State of California designated the Landscaping and Lighting Act of 1972, being Division 15 of the Streets and Highways Code of the State of California.

Section 9. Publication of Resolution of Intention: The City Clerk shall cause this Resolution of Intention to be published one time as required by Section 22552 of the California Streets and Highways Code, occurring no later than 10 days prior to the public hearing at which the City Council will consider levying the proposed special assessments. The published notice will encompass oneeighth of a newspaper page. The Perris Progress is hereby designated as the newspaper in which the City Clerk shall publish this Resolution of Intention. Upon completion of giving notice, the City Clerk is further directed to file in her office a proof of publication setting forth compliance with the requirements for publishing.

Section 10. Mailing of Notice: The City Clerk shall also give notice by a firstclass mailing to all owners of property subject to any new or increased assessments. The notice shall be mailed no later than 45 days prior to the public hearing at which the City Council will consider levying the new or increased assessments and shall be at least in 10-point type. The form of said notice shall conform in all respects with the requirements of subdivision (b) of Section 53753 of the Government Code and pursuant to subdivision (c) of that section, each notice shall contain an assessment ballot whereon the property owner may indicate support or opposition to the proposed assessment.

Section 11. Designation of Contact Person: That this City Council does hereby designate, John Pourkazemi, City Engineer of the City of Perris, (951) 943-6504 as the person to answer inquiries regarding the District and the proposed annexation thereto.

Section 12. Certification: The City Clerk shall certify to the adoption of this Resolution.ADOPTED, SIGNED and APPROVED this 11th day of June, 2024.

Mayor, Michael M. VargasATTEST:

City Clerk, Nancy Salazar

STATE OF CALIFORNIA )

COUNTY OF RIVERSIDE ) §

CITY OF PERRIS )

I, Nancy Salazar, CITY CLERK OF THE CITY OF PERRIS, CALIFORNIA, DO HEREBY CERTIFY that the foregoing Resolution Number 6422 was duly and regularly adopted by the City Council of the City of Perris at a regular meeting held the 11th day of June, 2024, by the following called vote:

AYES: ROGERS, NAVA, CORONA, RABB, VARGAS

NOES: NONE

ABSENT: NONE

ABSTAIN: NONE

City Clerk, Nancy SalazarSchId:12685 AdId:4495 CustId:18

Job No. P24-069

RESOLUTION NUMBER 6425A RESOLUTION OF THE CITY COUNCIL OF THE CITY OF PERRIS, COUNTY OF RIVERSIDE, STATE OF CALIFORNIA, DECLARING INTENTION TO ORDER THE ANNEXATION TO BENEFIT ZONE 185, CITY OF PERRIS LANDSCAPE MAINTENANCE DISTRICT NUMBER 1, DECLARING THE WORK TO BE OF MORE LOCAL THAN ORDINARY PUBLIC BENEFIT; SPECIFYING THE EXTERIOR BOUNDARIES OF THE AREA TO BE ANNEXED TO BENEFIT ZONE 185, LANDSCAPE MAINTENANCE DISTRICT NUMBER 1 AND TO BE ASSESSED THE COST AND EXPENSE THEREOF; DESIGNATING SAID ANNEXATION AS ANNEXATION OF TR 38071-1 TO BENEFIT ZONE 185, LANDSCAPE MAINTENANCE DISTRICT NUMBER 1; DETERMINING THAT THESE PROCEEDINGS SHALL BE TAKEN PURSUANT TO THE LANDSCAPING AND LIGHTING ACT OF 1972; AND OFFERING A TIME AND PLACE FOR HEARING OBJECTIONS THERETO ON JULY 30, 2024

WHEREAS, the City Council of the City of Perris (the “City”) has previously formed special maintenance districts pursuant to the terms of the "Landscaping and Lighting Act of 1972" (the "Act"), being Division 15, Part 2 of the Streets and Highways Code of the State of California, including the special maintenance district known and designated as LANDSCAPE MAINTENANCE DISTRICT NO. 1 (the “District”), and created BENEFIT ZONE 185 therein (hereinafter referred to as the "Benefit Zone 185"); and

WHEREAS, the provisions of Article II of Chapter 2 of the Act authorize the City Council to order the annexation of territory to the District; and

WHEREAS, on June 11, 2024, the City Council of the City of Perris, County of Riverside, California (“the City Council”) adopted its Resolution Number 6423 directing the Engineer of Work to prepare and file with the City Clerk of said City a report in writing as required by the Act; and

WHEREAS, said Engineer of Work has prepared and filed with the City Clerk of said City a report (the “Engineer’s Report”) in writing as called for in said resolution and under and pursuant to said act, which report has been presented to this City Council for consideration; and

WHEREAS, said City Council has duly considered the Engineer’s Report and each and every part thereof, and has found that each and every part of the Engineer’s Report is sufficient, and that no portion of the report requires or should be modified in any respect; and

WHEREAS, the City now desires to declare its intention to annex certain property into Benefit Zone 185 of the District, pursuant to the Act and, more specifically, Section 22587 thereof, and to take certain other actions as required by the Act; NOW, THEREFORE, BE IT RESOLVED, by the City Council of the City of Perris, California, as follows:

Section 1. Recitals. The Recitals set forth above are true and correct and are incorporated herein by this reference.

Section 2. Description of Work: That the public interest and convenience requires, and it is the intention of the City Council of the City of Perris to annex TR 38071-1 to Benefit Zone 185 of the District, and to order the following work be done, to wit:

1. Installation, construction, maintenance, and servicing of landscaping as authorized by Section 22525 of the Streets and Highways Code, State of California.

2. Any and all work and materials appurtenant thereto or which are necessary or convenient for the maintenance and servicing thereof.

Section 3. Location of Work: The improvements to be maintained and serviced include the irrigation system, landscaping, and appurtenances benefiting TR 38071-1. The landscaping, irrigation, and appurtenances to be maintained are described in part 1 of the Engineer’s Report.

Section 4. Description of Assessment District: That the contemplated work, in the opinion of said City Council, is of more local than ordinary public benefit, and this City Council hereby makes the expense of said work chargeable upon a District, which said District is assessed to pay the costs and expenses thereof, and which District is described as follows:All that certain territory of the City of Perris included within the exterior boundary lines shown upon that certain “Diagram of Annexation of TR 38071-1 to Benefit Zone 185, Landscape Maintenance District Number 1” heretofore approved by the City Council of said City by Resolution Number 6423, indicating by said boundary line the extent of the territory included within the proposed assessment district and which map is on file in the office of the City Clerk of said City.

Reference is hereby made to said map for a further, full, and more particular description of said assessment district, and the said map so on file shall govern for all details as to the extent of said assessment district.